Common Probate Questions we get from estate administrators, executors and personal representatives who are suddenly thrust into this role having never done it before and not knowing exactly what to expect. The truth is that the probate process can be very challenging if you’ve never experienced it before and it will require time, effort, research, and a good team of support personnel that specialize in various aspects of the process to assist along the way. A Probate Attorney for starters is the best first step to ensuring a smooth probate process.

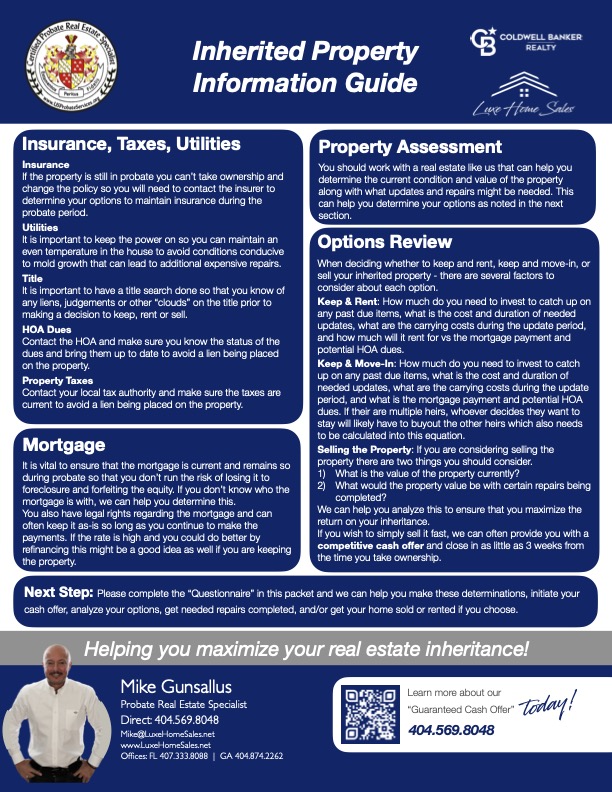

If there is real estate involved, a CPRES (Certified Probate Real Estate Specialist) will be invaluable in assisting you in the valuation process, what updates and repairs could increase the value, and helping to ensure that the payments are up to date so the house doesn’t face foreclosure during the probate process, the property taxes are current, and the property is properly insured.

This being said, let’s get to those Top 11 Common Probate Questions answered.

1) What is Probate?

Probate is the legal process of distributing a person’s assets and paying off their debts after that person passes away.

2) How long does probate take?

This varies widely based on various factors such as whether or not there is a Will, how many surviving heirs are involved and how well they agree with the Will or distribution of assets, creditor claims, tax issues, whether or not there is a business involved, and whether or not real estate is involved. That being said, probate can take as little as 2-6 months and as long as 12-18 months or more for more complex cases. Most of that time is spent waiting out the creditors claim period which is typically 3-4 months they have to make a valid claim against the estate.

3) Is probate difficult?

Probate is not usually difficult, especially if family members get along. It is simply a process in which many steps need to be followed, often in a timely manner. Probate can often get more complex if there are business ownership issues, tax related issues, property foreclosures, etc.

4) Should I try to avoid probate?

Most estate administrators will hire an attorney to help them determine how to proceed. It is often not necessary to try and avoid probate if the estate is simple and straightforward.

5) How can I avoid probate?

There are a few ways to avoid probate;

a) A properly created Revocable Living Trust

b) An estate only having assets that are not subject to probate

c) Insolvent estates (where there is more debt than assets)

d) Estate values below a set amount set by that state

e) Certain types of real estate deeds will help keep the real estate out of probate as well; Joint Tenancy with the Right of Survivorship, Tenancy by the Entirety, Community Property Agreements and Transferable on Death deeds.

Some of these options will require certain efforts be taken to transfer the deed and proof of death is often required as well.

6) Are certain assets not subject to probate?

Yes, a few examples include joint bank accounts, life insurance, anything with a payable-on-death designation, various brokerage accounts, assets in certain types of trusts, transfer on death deeds, among others.

7) Will the estate be subject to estate taxes?

a) Federal estate taxes apply if the estate has a total value greater than that of the current estate non-taxable limit by the Federal Government. This amount is subject to change and at the time of this posting it is $12.06 million.

b) State estate taxes vary from state to state, currently there is no estate tax in Florida which is one of only seven states not to levy an estate tax.

8) Is there an inheritance tax?

There is currently no federal inheritance tax, and FL does not have an inheritance tax. Some states do have an inheritance tax and it is recommended that you consult with an attorney about your specific case.

9) What happens if someone dies without a Will?

When someone dies without a Will it is called Intestate, and conversely – those who die with a Will in place have died Testate. When someone dies Intestate, probate will likely be necessary to determine how to distribute their estate.

10) Do family members have to pay the deceased person’s debts personally?

Only if a family member has co-signed on an outstanding debt. Otherwise, family members are NOT personally liable. It is important to note, the deceased person’s home may be foreclosed on if there is an outstanding mortgage that has gone unpaid. Credit cards, medical bills, and other debts only in the deceased person’s name do NOT have to be paid by the surviving family members.

11) What happens if the Testatee (decedent) has willed the house to an heir but the estate has legitimate debts that exceed the available funds of the estate?

In this case in the state of Florida the estate administrator would file for a Homestead Exemption to keep the home OUT of the probate process thereby protecting it from legitimate claims. If the estate does not have adequate funds to pay all debts of the decedent, they will be paid in sequence according to the legal code for that state.

The information presented above is informational only and is not to be construed as legal advice as it may not apply to all situations as circumstances vary, it is important that you consult with a Probate Attorney about your specific case to determine if these answers apply in your situation. If you would like to speak with a CPRES about certain real estate related questions, please visit our website at www.luxehomesales.net/probate/ and scroll down to the “Get in Touch” section and let us know how we can help. We will get back to you promptly.